RBI Cracks Whip On PMC Bank For Bad Loans!

Account-holders a beleaguered lot ! Bank confident of revival!

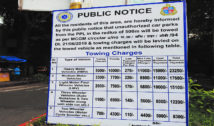

Mulund: Tuesday, September 24, 2019, turned out to be a black day for lacs of customers of Punjab and Maharashtra Co-operative (PMC) Bank across the state as the Reserve Bank of India (RBI) cracked a whip on the bank for being stressed with non-performing assets and bad loans. RBI superseded PMC Board of Directors and appointed an administrator to monitor the mis-deeds of the Bank. Further, cash withdrawals were initially capped at Rs 1,000 for a period of six months, but after public outcry the amount has been raised to Rs 10,000/-.

Dejected bank customers were left high and dry at the sudden turn of events at the Bank. Lalchand Amesar, who has many accounts in the Mulund Branch of PMC Bank lamented, “I am devastated by the clampdown on PMC Bank because I hold five accounts in the Bank. I have been a loyalist account-holder of the Bank ever since the branch started in Mulund. I have lakhs of rupees deposited in the Bank and now I am left in the lurch to withdraw just Rs 10,000/-“ He moaned, “How will I manage my expenses with such meagre funds? The RBI must find a solution at the earliest and help the innocent depositors from the dilemma.”

When Home Times took the public grievance with the PCM Mulund branch, an official of the Bank said, “Customers need not panic. The Bank has promised to stand by its customers. In the times of emergency like medical, education or for a wedding ceremony, the Bank would consider the request application of its customer. This application would be put up to the RBI administrator at PMC Bhandup Branch and he would take a final call and provide money as per RBI guidelines.”

Commotion outside PCM Bank branches

Red-faced and panic-stricken customers were witnessed outside the PMC Bank in Mulund Colony. From top-notch businessmen to poor auto-rickshaw drivers, to pensioners to senior citizens to small shop-owners, everybody looked desperate. According to reports, the PMC Mulund branch has over 30,000 customers, mostly residents of Mulund Colony and Amar Nagar.

The residents of Amar Nagar are worst hit as these people belong to the underprivileged category of society and lead a hand-to-mouth existence. They make a daily earning and save their hard-earned money for any crisis. But, alas, their hard-money has been cruelly milked away by the real estate giant Housing Development Infrastructure Ltd (HDIL), in collusion with the corrupt babus of PMC Bank!!

Left dumb-founded by the PMC farce, a poor auto-rickshaw driver, Popat Patil told Home Times, “I make a daily earning and would deposit Rs 1,000/- or 1,500/- daily in the PMC Mulund branch to avoid unnecessary expenditure, but now I am in a soup. The festive season is around the corner. How will we celebrate? After Diwali, I have to spend money for surgery on my ailing mother?? How will I manage that? I am totally confused.”

What went wrong at PMC Bank?

According to reports, real estate giant Housing Development Infrastructure Ltd (HDIL), in cahoots with the corrupt babus of PMC Bank, had acquired a whopping loan of Rs 2,500 crore which the company has failed to repay. What is shocking is that despite HDIL being a defaulter, the corrupt PMC Bank officials did not notify the RBI about the irregularities of NPA (Non-performing Assets) and this created the mess.

What is Section 35A of the Banking Act?

The RBI has put PMC Bank under Section 35A of Banking Act for the irregularities and mis-management of bank funds. The bad loans could result in the Bank’s insolvency. Hence, to avoid bankruptcy, the RBI would forcibly merge the bank with some stronger bank. However, before that, PMC must manage a miraculous recovery in the given 6 months, rectifying alleged irregularities and improving financials.

PMC Bank has Rs 11,500cr deposits

Established in 1984, PMC Bank has given 8,300 crore as loans. The PMC Bank has a public deposit of more than 11,500 crores. In Maharashtra, PMC has 103 branches; In Karnataka, there are 15 branches and Goa- 6; Delhi -6; other states that have branches include Gujarat, Andhra Pradesh, and Madhya Pradesh.

“No need to panic; Your money is Safe!”- Rajneet Singh (Director, PMC Bank)

In an appeal to the lacs of PMC Bank customers, Rajneet Singh, the Director PMC Bank has assured them that their money is safe!

He has urged the customers to remain aloof from rumours and need not panic. “I wish to inform my customers that I was unaware of the irregularities of the bad loan to the company that went into insolvency. Nevertheless, I promise to bring out the PMC Bank form this crisis not in 6 months but within just 2 months. Kindly trust me and keep faith in our Bank.”